How I Took Control of My Chronic Illness Costs Without Sacrificing Care

Living with a chronic condition hit me hard—not just physically, but financially. I felt trapped by endless bills and hidden costs. After years of trial and error, I discovered practical ways to cut expenses without compromising health. This is the guide I wish I had earlier: real strategies, tested in real life, that actually work. Let me show you how small financial shifts can lead to big relief. It’s not about choosing between health and wealth—it’s about aligning both so you can live fully, without constant worry over medical bills.

The Hidden Financial Toll of Chronic Illness

Chronic illness brings more than physical discomfort—it introduces a persistent financial strain that often goes unspoken. Many people focus on managing symptoms, but few recognize the long-term economic impact of living with a condition like diabetes, arthritis, or heart disease. These are not occasional health setbacks; they require ongoing care, regular monitoring, and consistent treatment. The costs accumulate quietly: monthly prescriptions, routine blood work, imaging scans, durable medical equipment, and frequent visits to specialists. Over time, these expenses can rival a household utility bill—or exceed it.

What makes this burden particularly challenging is its unpredictability. A sudden flare-up or complication can lead to emergency visits or hospital stays, resulting in unexpected charges even for those with insurance. Co-pays, deductibles, and out-of-network fees add up quickly. For some, the financial pressure leads to difficult choices—skipping doses, delaying tests, or avoiding care altogether. These decisions may offer short-term savings but often result in worse health outcomes and higher costs down the line. Recognizing this cycle is the first step toward breaking it.

Understanding the full scope of chronic illness expenses allows individuals to shift from reactive spending to proactive planning. Instead of being caught off guard by recurring bills, patients can begin mapping out their healthcare needs and associated costs. This awareness transforms healthcare from a source of anxiety into a manageable part of life. It’s not just about counting dollars—it’s about regaining control. When people see their medical spending clearly, they can make informed decisions, prioritize what matters most, and protect their financial well-being while maintaining high-quality care.

Building a Realistic Health Budget You Can Stick To

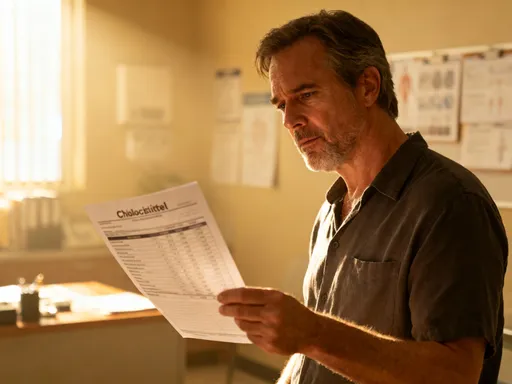

Creating a budget is common financial advice, but standard budgeting models often fail to account for the irregular and essential nature of medical expenses. When I first tried budgeting, I treated healthcare like groceries or entertainment—something flexible and adjustable. That approach backfired. Unexpected lab fees, prescription refills, and specialist visits disrupted my monthly balance, leaving me stressed and scrambling for cash. The turning point came when I committed to tracking every health-related expense for three full months. I recorded everything: insulin pens, glucose test strips, parking at the clinic, even phone calls to insurance.

This detailed tracking revealed patterns I hadn’t noticed before. Certain costs occurred predictably every few weeks, while others appeared seasonally—like allergy medications in spring or joint pain treatments in winter. More importantly, I identified redundancies: duplicate lab orders, over-the-counter supplements I didn’t truly need, and brand-name drugs available in lower-cost forms. With this data, I built a new kind of budget—one designed specifically for chronic care. I divided medical costs into two tiers: a baseline monthly amount for essentials and a separate emergency reserve for unforeseen events.

Treating healthcare as a fixed, non-negotiable expense—like electricity or rent—changed my mindset. I began setting aside money each month, regardless of whether I had an appointment or not. This created a buffer that absorbed surprises without derailing my finances. I also scheduled annual reviews to adjust for changes in treatment plans or insurance coverage. By building flexibility into the structure, I avoided rigid constraints while maintaining discipline. Over time, this system reduced financial stress and eliminated last-minute payment panics. The peace of mind was profound: knowing I was prepared, no matter what my body threw at me.

Smart Medication Management: Saving Without Risk

For most people managing chronic conditions, prescription drugs represent the largest recurring expense. After reviewing my own spending, I realized nearly 60% of my monthly health budget went toward medications. Determined to reduce this burden without compromising effectiveness, I began exploring smarter ways to manage my prescriptions. The first step was understanding the difference between cost and value. A cheaper drug isn’t helpful if it doesn’t work—but many effective alternatives exist at significantly lower prices. I learned to ask questions: Is there a generic version? Can I get a 90-day supply? Is mail-order delivery more economical than picking it up at the pharmacy?

Switching to generic medications—when approved by my doctor—was one of the most impactful changes. Generics contain the same active ingredients as brand-name drugs but cost a fraction of the price. In many cases, the only difference is the packaging. My doctor and I reviewed each medication to confirm safety and suitability, ensuring I wasn’t cutting corners on care. I also shifted to 90-day supplies through mail-order pharmacies, which often offer lower per-unit pricing and eliminate frequent co-pays. This reduced both cost and the time spent managing refills.

Another key strategy was syncing my prescription renewals. Instead of refilling different drugs at different times, I worked with my pharmacy to align them every three months. This simplified tracking and reduced administrative oversights. I also started using manufacturer discount programs and pharmacy loyalty cards, which provided additional savings. Importantly, I never stopped taking prescribed medications to save money. Instead, I focused on optimizing how I accessed them. These adjustments didn’t eliminate costs, but they made them far more manageable—freeing up funds for other health priorities and reducing monthly financial strain.

Navigating Insurance Like a Pro, Not a Patient

Health insurance is meant to protect, but without careful attention, it can become a source of confusion and hidden costs. For years, I treated my insurance plan as a mysterious system I couldn’t understand. I assumed bills were accurate and coverage was automatic. That changed when I started reviewing my Explanation of Benefits (EOB) statements after every visit. These documents, often overlooked, show exactly what services were billed, how much the insurer paid, and what I owed. I discovered discrepancies—charges for tests I didn’t receive, duplicate billing, and out-of-network fees for providers I thought were covered.

Once I began questioning these charges, I recovered hundreds of dollars in errors. I also learned to verify a provider’s network status before every appointment. A simple phone call to customer service or a quick check on the insurer’s website prevented costly mistakes. During open enrollment, I stopped automatically renewing my plan and instead compared options based on my actual usage. I evaluated deductibles, co-pays, and formulary lists—the approved drugs covered by the plan. Sometimes, a slightly higher premium came with much lower out-of-pocket costs for my specific medications, making it the smarter financial choice.

I also took advantage of preventive care benefits, which are typically covered at 100% under most plans. Annual physicals, screenings, and vaccinations became part of my routine—not because they were free, but because they prevented future expenses. Understanding my plan’s structure empowered me to make strategic decisions. I scheduled certain tests and procedures after meeting my deductible but before the year ended, maximizing coverage. I avoided emergency rooms for non-emergencies by using urgent care centers, which charged less. By treating insurance as a tool to be managed rather than a passive benefit, I gained greater control over both my health and finances.

Preventive Care as a Financial Strategy

At first glance, spending money on regular check-ups and screenings may seem like an added expense. But in reality, preventive care is one of the most effective ways to reduce long-term medical costs. I used to skip routine visits when I felt fine, thinking I was saving money. Then, a minor symptom I ignored led to a severe flare-up requiring hospitalization—and a bill that took months to pay off. That experience taught me a crucial lesson: prevention isn’t an expense; it’s an investment. Catching issues early often means simpler, less invasive, and far less expensive treatment.

I began working with my doctor to create a personalized prevention plan based on my condition, age, and family history. This included scheduled blood work, imaging studies, and specialist evaluations at recommended intervals. We also discussed lifestyle adjustments—nutrition, exercise, sleep hygiene—that could reduce complications. These proactive steps didn’t guarantee perfect health, but they significantly lowered the risk of emergencies. Over time, I saw fewer urgent care visits, avoided multiple hospitalizations, and maintained better overall function.

The financial benefits became clear within a year. The cost of regular monitoring was a fraction of what I had previously spent on crisis management. Insurance typically covers preventive services fully, so many of these appointments required no out-of-pocket payment. Even when there was a small co-pay, it paled in comparison to the thousands saved by avoiding major procedures. More importantly, staying ahead of complications meant I could continue working, traveling, and enjoying life without prolonged disruptions. Preventive care didn’t just protect my health—it protected my income, my savings, and my independence. It proved that sometimes, the smartest financial move is the one that keeps you out of the hospital.

Leveraging Community and Nonprofit Resources

For a long time, I believed that financial help was only for people in extreme poverty. I thought asking for assistance was a sign of failure. That mindset kept me from exploring valuable resources designed specifically for people managing chronic illness. Then, a nurse at my clinic mentioned a patient assistance program for my medication. I applied—and received a year of free prescriptions. That single act opened my eyes to the wide network of support available. Nonprofit organizations, pharmaceutical company programs, and local health departments offer real help to those who qualify, often regardless of income level.

I began researching programs related to my condition and discovered several that provided financial aid for prescriptions, medical supplies, and even transportation to appointments. Some labs offered discounted or free testing for uninsured or underinsured patients. Local clinics operated on a sliding-scale fee system, adjusting costs based on income. I applied to multiple programs and was approved for three. These weren’t handouts—they were structured support systems meant to ensure people could access necessary care without financial ruin.

Accessing these resources didn’t diminish my independence; it enhanced it. Instead of choosing between medication and groceries, I could afford both. The savings allowed me to build a small emergency fund and even contribute to a health savings account. I also connected with support groups where people shared tips on navigating insurance, finding low-cost providers, and managing daily challenges. These communities offered emotional support as much as practical advice. By embracing help when it was available, I became more resilient, not less. I learned that resourcefulness isn’t about doing everything alone—it’s about knowing where to turn when you need support.

Long-Term Planning: Protecting Health and Wealth Together

Managing chronic illness isn’t just about handling today’s bills—it’s about securing your future. Once I gained control over immediate expenses, I turned my attention to long-term financial health. I realized that without planning, even small ongoing costs could erode savings over decades. I began by creating a dedicated health savings fund, separate from my general emergency fund. Each month, I contributed a set amount, building a reserve specifically for medical needs. This fund covered co-pays, non-covered treatments, and unexpected expenses, reducing the need to dip into retirement accounts or rely on credit cards.

I also reviewed my overall financial strategy with a fee-only financial planner who specialized in working with clients managing long-term health conditions. This professional helped me evaluate my insurance coverage, retirement projections, and estate planning documents. We discussed long-term care options and the potential need for home modifications or assistance services in the future. These conversations were not about fear—they were about preparation. By addressing potential scenarios now, I could make informed choices and avoid crises later.

One of the most empowering steps was aligning my financial goals with my health goals. Instead of seeing money and wellness as separate domains, I began treating them as interconnected. Every financial decision—how I saved, spent, or invested—was made with my health in mind. This holistic approach gave me greater confidence and reduced anxiety about the future. I wasn’t just surviving; I was building a sustainable life. Knowing I had a plan in place allowed me to focus on living well, not just managing illness.

Chronic illness doesn’t have to mean financial surrender. With practical steps, clear thinking, and consistent effort, it’s possible to reduce costs while maintaining quality care. The journey isn’t about perfection—it’s about progress. Every small decision adds up. By taking charge of the financial side, you reclaim power over your life. And that’s a relief no medicine can match.